REACH YOUR GOALS Want To Buy a Home Now? Consider These Strategies. Whether you’re a first-time or move-up home buyer, you may be considering postponing a purchase if your area’s affected by climbing home prices. Or you may be balking at today’s mortgage. However, no matter where prices and rates may be, you have some different strategies to consider. Buy now, refinance later. While it’s impossible to predict when interest rates will change, almost all lenders expect rates to eventually go down. If you’re buying in an area where home prices are still rising, this approach could be worth considering, especially if you’re renting and not building equity. Make a larger down payment. If you have the funds to do this, it could help you in several ways. In addition to a possibly lower interest rate on a mortgage, it will provide lower monthly payments. Also, you may be able to forgo mortgage insurance or cancel it sooner than later. Consider a shorter loan term. While this translates into higher monthly payments, it also earns you a lower rate. For example, while the current average rate for 30-year loans was 6.71% earlier this week (according to Freddie Mac), 15-year loans came in at an average rate of 6.06%. You’ll also save quite a bit in long-term interest.1 |

|---|

MORTGAGE IQ Will The 3% Loan Rate Ever Return? If you’ve decided to postpone buying a home because of the current interest rates, it’s possible that you could wait longer than you’d planned. |

|---|

FINANCIAL NEWS Consumer Confidence Continues to Rise According to the nonprofit think tank The Conference Board*, consumer confidence recently rose to its highest level in 17 months. |

|---|

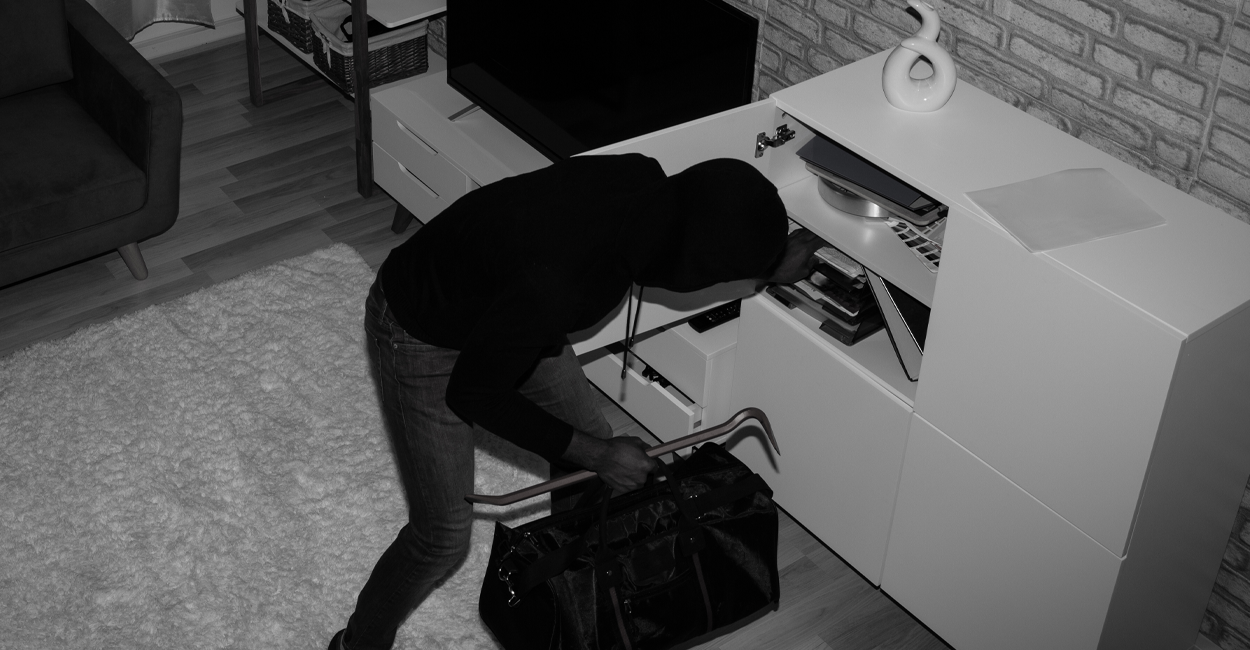

DID YOU KNOW? Think Like a Burglar Before Vacation. Vacations should be 100% fun and relaxing, but it can be difficult to kick back if you’re worried about burglars taking advantage of your absence. While it’s always smart to stop your mail and activate a security system, there are other things you can do to deter break-ins. And since they’re subtle clues that only burglars tend to consider, they may have never crossed your mind. Don’t have a dog? Fake it. Security pros agree that dogs are an excellent deterrent: even if they don’t bark to raise the alarm, nobody wants to be bitten. You can pretend to own one by leaving a dog leash or bowl at the door, and even going the extra mile by putting up a “Do Not Let the Dog Out” sign or similar on a fence or gate. Put work boots to work. Leaving one or two pairs of muddy work boots outside your front or back doors suggests that someone’s around. (Stop by a thrift shop and grab a pair if you don’t have any.) If you live alone, a family’s worth of footwear left outside can artificially bump up your home’s population, even when you’re not away. Light them up. In addition to using light timers inside the house, install motion detector lights to deter unwanted evening visitors. Be sure to mount these lights as high as possible so a burglar can’t simply unscrew the bulb or break the fixture. Share your vacation selfies later, not sooner. Some burglars follow social media and make notes of anyone posting pics from afar. Save your holiday photos until you’re home…you’ll have more time to edit out sunburn, bad hair or photo-bombing tourists before posting them.4 |

|---|

PERSONAL FINANCES Should You Consider a Driver Monitoring App? You may be aware that more auto insurance companies are adopting methods to evaluate their customers’ driving performance. It’s a simple premise: if a data tracker (usually a phone app) tells your insurer that you practice safe driving habits, you may earn a lower premium. This is something many of us are searching for as rates and prices continue to climb. While the first driver usage trackers were plug-in devices, they’ve evolved into iPhone and Android apps. You may recognize one or more of these “telematics programs”: Progressive’s Snapshot, Drive Safe & Save by State Farm, and DriveEasy from Geico. If you’re considering allowing your insurer to monitor your driving habits so you may possibly save on your premium, here’s some of the types of data it may collect: How much you drive, how fast, and what times of the day you drive Hard braking and rapid acceleration (both considered no-nos) Whether you’re naughty and text while driving If you’re undecided whether to use one of these apps, here are a few things to consider. Even if you had a legitimate reason for braking hard or speeding up quickly—for example, if you brake to avoid a jaywalker—the app will record this as high-risk and possibly ding your score.If your work hours are considered high-risk (most apps consider driving between 12 midnight and 4:00 am to be riskier for drivers), you may want to discuss this with your insurance company. If you aren’t comfortable sharing such a large amount of personal information, you may want to stick with your current policy.5 |

|---|